As tax season comes to a close, Bookkeeper360 wants to share some top tips for your small business to consider. Keeping these tips in mind will help your business make better day to day financial and operational decisions - while setting the stage for making taxes a breeze.

Cloud Accounting Software

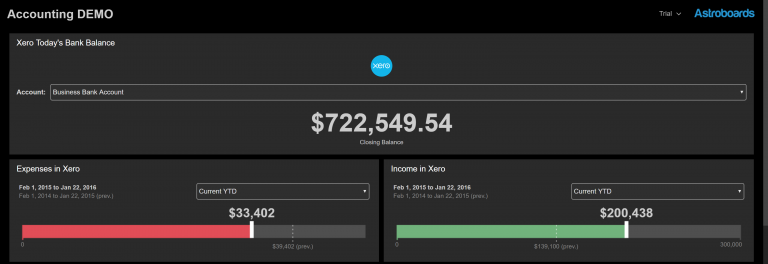

- Whether it is Xero, QuickBooks Online, or another accounting system, migrate your books and financials over to a cloud platform. The benefits are endless and allow for real-time data to be entered and accessed from anywhere on mobile or desktop.

- The possibility for errors to occur is greatly mitigated with complete visibility of all user actions and minimal manual calculations.

Reconcile Bank Statements

- Don’t let reconciling bank statements get away from you. The more time that goes by, the more data that potentially will be forgotten, entered in error or missed completely. Xero’s reconciliation process occurs daily and not at the end of the month, allowing for essentially real-time updates.

- Your bottom line should not be negatively impacted by mistakes in reconciliation - look into how your cloud accounting solution can make this process a breeze.

Inventory Management

- If you sell a physical product, utilize appropriate inventory management systems to help prevent inventory theft, assist with demand planning, and keep tabs on trends and efficient buying.

- Analyze KPIs found in your cloud bookkeeping platform to learn what products or solutions exhibit the highest profit margin. Use these KPIs to maximize sales of these items and optimize your margins.

Manage Accounts Receivables

- Sales are great - sales on credit are also great if your business has a plan in place to handle them. Having guidelines and terms for your customers placing orders on credit are essential to complete the sales process. Creating deadlines and offering multiple forms of payments will allow clients to meet these terms. Chasing after receivables after they come due costs your business cash flow, assets, and time while allowing your client to essentially have an interest free loan.

Review your Books

- Set some time to review your company finances to make sure all is accurate and as expected. With cloud technology such as Astroboards, this process will be easier and more detailed than ever before through visualization of key KPIs.

- Reviewing your books on a monthly basis will keep you in the know of your business trends and in keeping a fresh perspective. Bringing in a professional firm to assist with a monthly review will confirm and ensure accuracy.

By recognizing the bookkeeping tips above, your business can rest assured that the books will no longer be a massive burden to bear. Staying on top of your bookkeeping will provide greater business insights, ensure timely reporting, and assist in making the right business decisions.